How to Create a Startup: The Blue Ocean Strategy

Learn how to create uncontested market space and make your competition irrelevant

Highlights:

- Discover a bold business strategy that rewards innovation and casts competition aside.

- Equip yourself with the analytical tools necessary to implement a Blue Ocean Strategy.

- Learn target costing and strategic pricing.

Summary of BLUE OCEAN STRATEGY: Creating Blue Oceans and Blue Ocean Analytic Tools

|

| Source: Kim, WC & Mauborgne, R 2015, Blue ocean strategy, exp. edn. p. 7. HBS Publishing, Boston. |

Comparing Two Oceans

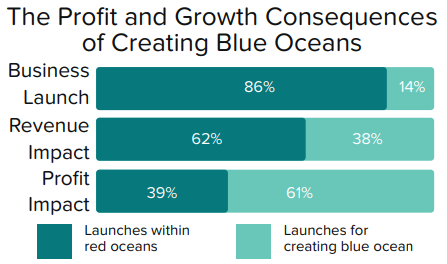

- Blue Oceans: Untapped market space free of competition, where firms can create customers. Blue oceans have the potential to provide rapid profit growth.

- Red Oceans: Established markets with entrenched industry practices and intense competition for profits.

- Strategic move: The set of decisions a firm makes to create blue oceans.

- Value innovation: Creating an increase in value to customers while reducing firm costs, rendering competitors irrelevant.

- Value-cost trade-off: The paradigm of many competitive strategies in which greater value comes at a greater cost and lower value comes at a lower cost.

The Strategy Canvas

- Strategy Canvas: A tool used to illustrate a company’s competitive strategy.

- Factors of competition: Factors that an industry competes on and invests in; for example, price.

- Value curve: A line made by plotting a company’s profile across a strategy canvas.

Optimizing Strategy

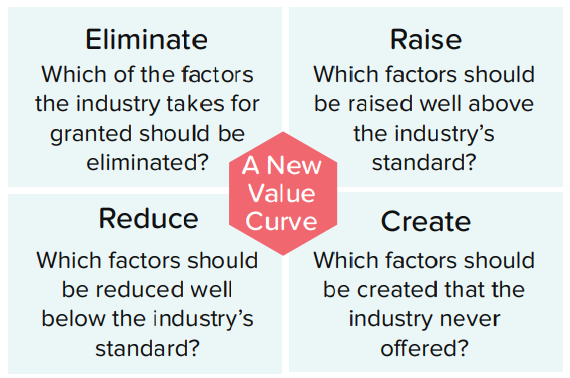

Four actions framework: Four questions used to facilitate understanding or formulation of a company strategy.

Eliminate-reduce-raise-create (ERRC) grid: A helpful tool used to complement the four actions framework.

Successful Blue Ocean Strategy has three hallmarks:

- Focus: An emphasis on only key factors of competition.

- Divergence: A break from an industry’s prevailing strategies.

- Compelling tagline: e.g. Southwest’s, “The speed of a plane at the price of a car—whenever you need it.”

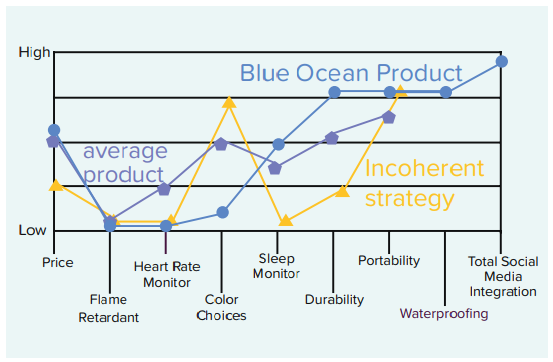

Reading Value Curves

High investment across all factors signifies overdelivering without payback: investing in options or features that add little value for consumers.

Zigzags indicate a corporation with an incoherent strategy. A divergent curve indicates a blue ocean product.

Strategic Pricing

Price corridor of the mass: A process for finding an optimal price point involving the following two steps:

- Identify any existing alternatives to your product, either with differing forms and the same function, or differing form and function, but the same objective.

- Examine the price and user base of each alternative

Network externalities: A phenomenon in which people place little value on a product used by few others. This makes setting a strategic price crucial.

Nonrival goods: Resources anyone can use.

Low excludability: Causes a product to be vulnerable if it doesn’t have a limitation on its use by rival firms.

Target Costing

Three levers of cost reduction:

- Streamlining: Simplifying and optimizing operations.

- Partnering: Forming strategic alliances to share cost burden with other firms.

- Pricing innovation: Changing the way a product or service is monetized, e.g., Blockbuster’s choice to rent videotapes to consumers rather than to sell them.

Strategic Sequence

Strategic sequence: A four-step process for formulating and evaluating blue ocean ideas.

- Buyer utility: The amount of value a product or service delivers to a buyer. This can be increased either by pulling one of the six utility levers, or by removing blocks to buyer utility.

- Strategic pricing: Setting a price that will attract the greatest number of customers in the shortest amount of time.

- Target costing: Using insights gained from determining optimal price points to set your target cost of production.

- Adoption: Ensure smooth adoption by engaging and educating the three primary stakeholders: employees, business partners, and the general public.

Blue Ocean Idea Index: A birds-eye view of the commercial viability of blue ocean ideas.